I have some macro views but I’d never embarrass myself by writing a newsletter about them. No, my base case is that 2023 is going to allow me to accumulate assets on the cheap that I expect to be worth significantly more in 2024.

Stay warm out there.

January Trades

Closed positions

- Ecopetrol $10 May calls sold for a 50% gain

Scalp/Swing trades during tax-loss selling

- Traded around Altiplano Metals position for a 35% gain

- Traded around Minera Alamos position for a 11% gain

- Still holding additional Athabasca Minerals shares

The Ecopetrol options trade was designed as a leveraged bet with a short fuse on the upcoming divided announcement. Ultimately I wanted the money to deploy elsewhere so I decided to close the trade early and probably ended up leaving money on the table.

I’m not the first person to buy during December tax-loss selling season and pocket a nice little profit when everyone’s P&L resets in January.

Buying Amerigo, Bancolombia and Grupo Aval was about building larger positions in potential multi-baggers with large, and largely sustainable, dividends. They were always meant to be held.

However, Altiplano Metals, Minera Alamos and Athabasca Minerals are full positions that did not perform at all in 2022. Adding more was about trying to swing trade a quick profit and make some money on companies that I believe in more than the market. With Altiplano and Minera it worked. I overestimated the liquidity on Athabasca, so I’m still holding the extra shares and that was not my intent.

Swing trades don’t address the larger issue: I will have to make a decision by next quarter on what I want to do with these positions if they continue to underperform.

- Altiplano is behind schedule generating cash flow from its new mill

- Minera Alamos is flush with cash but facing a water shortage

- Athabasca Minerals is still dealing with negative investor sentiment from last year’s strategy pivot, and ousting its previous CEO.

Whether it’s sand, copper or gold … mine building is hard, even for good managers.

New buys

- Vulcan Minerals

Starter positions

- Midwest Energy Emissions (previously listed as an undisclosed microcap)

- Prospera Energy

Vulcan Minerals is collection of shares, royalties and development assets trading at a negative enterprise value.

- 33% equity stake in Atlas Salt, which is putting the Great Atlantic salt deposit into production

- A 3% net production royalty on Great Atlantic

- 10% equity stake in Triple Point, which will eventually be listed on the CSE and owns the Fischell Brook Salt Dome

- A 3% royalty on Fischell

- A collection of copper-gold and nickel exploration properties in Newfoundland, several of which have been optioned in exchange for shares, cash and royalties.

- $6.3-million in cash as of September 30, 2022 with no significant liabilities.

Atlantic Salt closed the week with a market cap just above $150-million after the market reacted poorly to its PEA on Great Atlantic. Vulcan fell in sympathy and has a market cap of $33-million, less than the value of its Atlas Salt shares. We’ll go to Twitter to lay out the high-level risk/reward investment case:

I’d encourage you to read that whole Twitter thread. The exploration assets have some value, but the success or failure of the investment is binary and rests on the Great Atlantic royalty. Mr. Market focusing on the payback period and after-tax IRR of a mine that will be in operation for more than 100 years doesn’t make a lot of sense. These shares can be purchased and put away at current prices. Similar to Great Bear Royalty I expect to wake up one day with a large buyout premium and a great IRR on VUL.V.

Prospera Energy popped up in my screens in September when they settled some debt owed to a joint venture partner. The screen was a simple Google alert I use to flag recapitalizations. Prospera went onto a watchlist and I forgot about it until I saw this a week later.

“The reorganized efforts of Prospera have resulted in increased gross production from 80bpd to 800bpd, Q2 revenue grew by 860%, reserve asset value grew from -3.4m$ to 56.2m$ from the previous year. Settled 14m$ of legacy arrears, reduced ARO liability by 1.5m$ and addressed over 400 legacy non-compliances to be fully regulatory & environmentally compliant. Further, PEI acquired 50% light oil interests to diversify product mix and to realize higher margin. In addition, strategic acquisition to expand in the core area that can double the current operation and inventory to attain 5,000bpd over the next 24 months. PEI is expected to exit this year at 1,500bpd.”

Well that’s interesting! I started picking away in December after Prospera got production going and showed they could execute. I wasn’t exactly overflowing with cash to put into a distressed microcap, but I figured I had plenty of time.

Then the podcast happened …

I like Mining Stock Education. I don’t listen to as many podcasts as I used to when I was driving to work, but the non-company episodes are great pieces of learning material and the right length to accompany any number of mundane household tasks. As you can imagine this episode blew up my quiet accumulation strategy.

Not close to a full position, but no reason to keep it secret anymore. I’m hoping this will float back to 10 cents when the tourists exit – a turnaround will be bumpy and take years. I expect most people to forget why they bought it by next quarter. The selling pressure may end up as a gift, keeping PEI.V close to 10 cents even as management executes.

Now that it’s suddenly run up in price I don’t intend to add anymore shares of Midwest Energy Emissions either. I was able to sell enough shares to get my original capital out and fund some of my other purchases. I’ll be watching how MEEC performs in court with its patent infringement cases, whether it can keep adding licensing agreements and the debt situation.

MEEC is a small position but I’ll consider adding at higher prices if management executes and the value proposition improves faster than the share price.

Old friends

- Re-entered EnWave

- Re-entered Pieridae

- Added to CVR Partners

I traded out of Pieridae Energy to help fund my tax-loss buying spree last month.

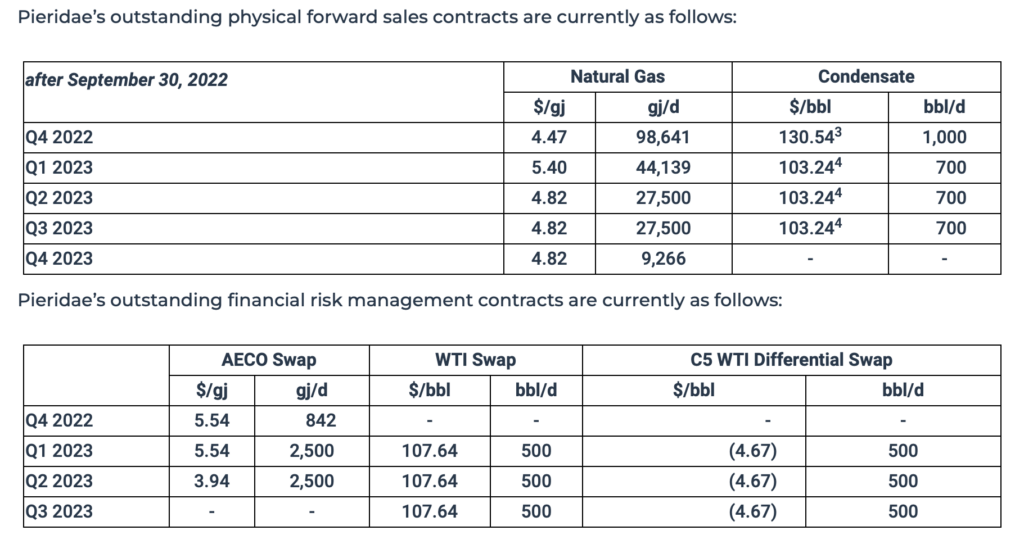

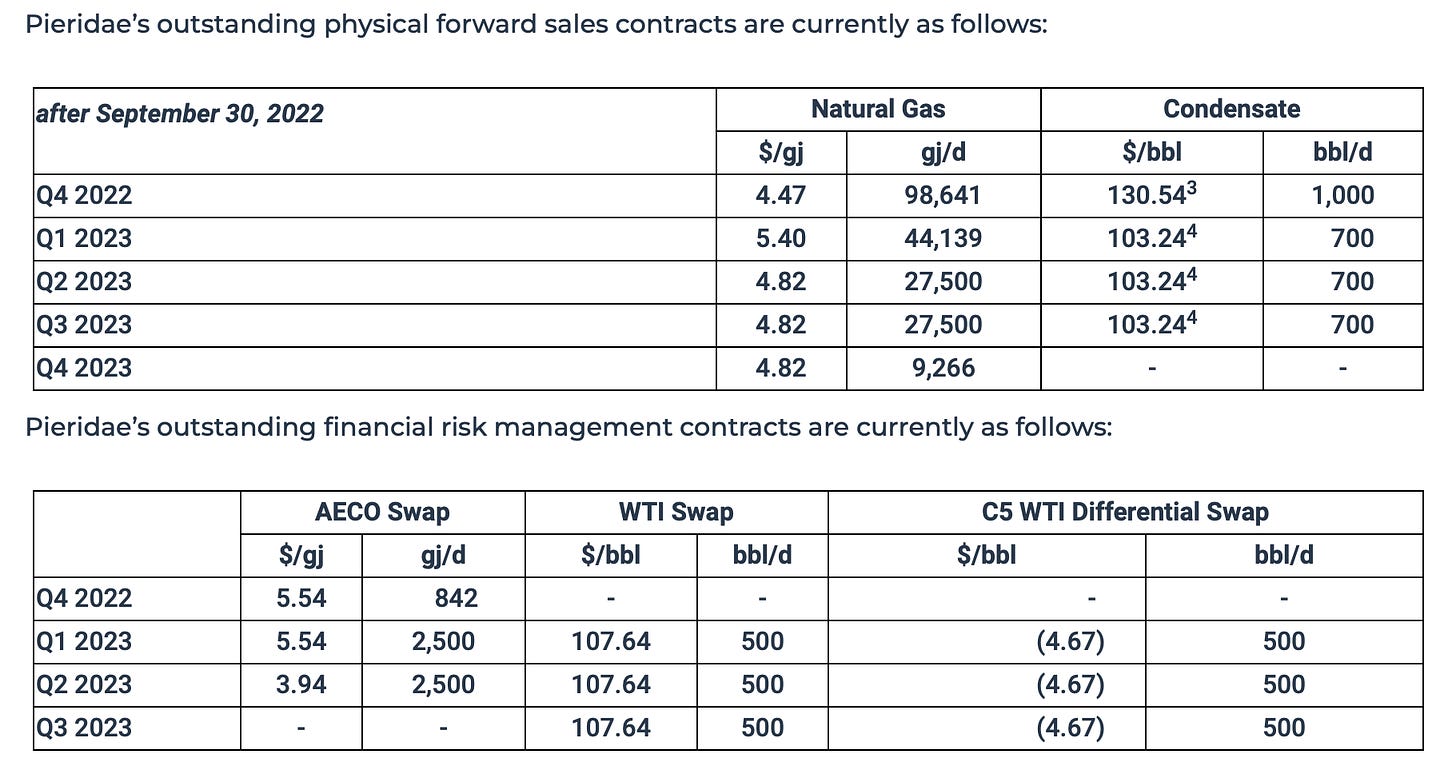

When it comes to natural gas the underlying commodity is definitely not running, but the Pieridae hedge book makes a punt worthwhile at current prices.

I’m prepared to add in size if PEA.TO keeps falling and the hedge book lasts long enough to get past the natural gas price trough. I have my technical marks all laid out.

EnWave gets another chance because they’re getting out of the business of selling cheese and putting that effort and capital into the core licensing business. Adding to CVR Partners ahead of earnings is a bet that a $10-$15 distribution will win out over sentiment around “fertilizer” prices.

Salazar Resources- Star Royalties

- Globex Minerals

- SolGold

- Iris Energy

- Purpose Ethereum Yield ETF

- Vitalhub

Vitalhub came to my attention because it runs dev-ops out of Sri Lanka. It’s optically cheap but it has currency exposure and I’ll be watching for a while before I put any money in. The history of TSX-listed software rollups is dubious. MEEC moves off the watchlist as a starter position, while Algoma Steel gets punted for surging in price over the last few weeks.