- PetroBras OTM Jan 2025 calls

- PetroBras common

- Ecopetrol $10 May calls

- EWW OTM 2025 calls

- Colombian banks

- Undisclosed US microcap (starter position, patent/IP play)

The Latin American theme wasn’t intentional, it just happens to be where the simple mean reversion trades and secular growth are.

The volatility on the PetroBras options allowed me to get my original capital out, break off another piece to buy some more common when it dropped below $10, and let the rest ride. Unfortunately 2025 calls aren’t liquid enough for swing trading purposes – depending on the day they can be marked at +550% or -65%.

The Ecopetrol options are a bet on the upcoming dividend announcement. Why settle for 20% when you can reach for 200 at the risk of getting nothing?

EWW is the iShares Mexico ETF as I’m not going to pretend to understand enough Spanish to pick Mexican stocks. Buying options in this case is about conserving capital to take some big swings later this year.

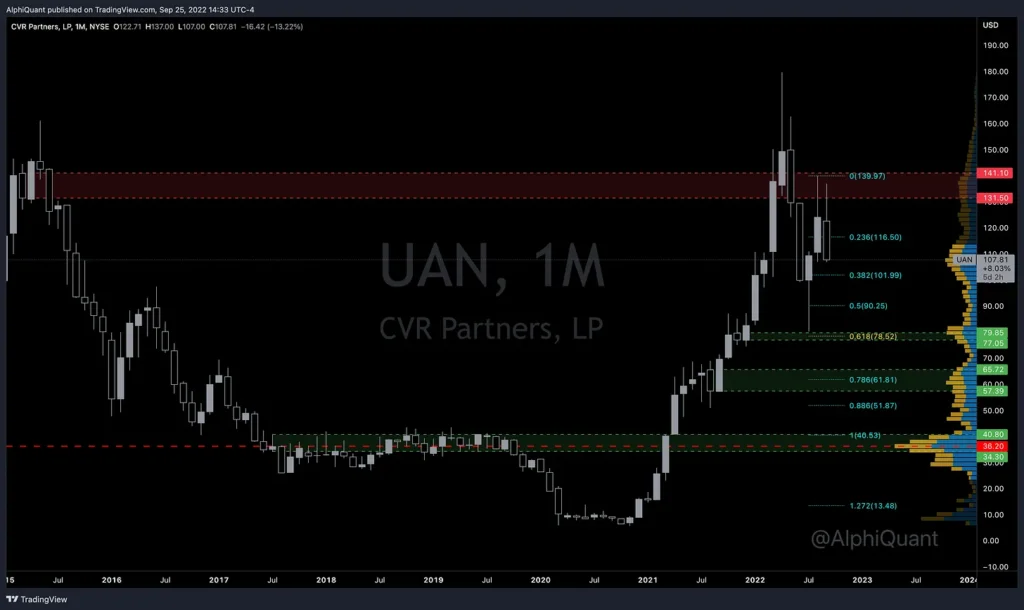

For example: I have my technical marks for CVR Partners and I’m going to be disciplined about waiting for those levels before adding more UAN.

I’m probably done adding to AVAL and CIB unless they pull back completely. They’re both still statistically cheap but they’ve jumped ~20% from my cost price. The perceived political risk in Colombia is overblown, but it’s not zero either.

Public Watchlist

- Salazar Resources

- Star Royalties

- Globex Minerals

- SolGold

- Algoma Steel

- Iris Energy

- Purpose Ethereum Yield ETF

- Undisclosed US microcap (coal related, patent/IP play)

Putting SolGold aside for a moment, the other three mining prospects are pretty basic sum-of-the-parts trades.

- Share prices seem to have diverged too far from the underlying asset prices.

- The people in charge don’t seem to be crooks and are working in good faith to close the valuation gap.

We’ll use Star Royalties as an illustrative example. Star is a broken IPO, having gone public in 2021 to finance a streaming deal on the Copperstone gold mine. Copperstone still isn’t in production and market sentiment has cooled off for carbon credit royalties, which make up Star’s other flagship asset known as Green Star Royalties. The plan is to eventually spin off Green Star as a pure-play.

Some high-level base assumptions:

- Rising gold prices will provide a floor for my estimated Copperstone stream valuation below.

- We can have some confidence Sabre Gold is taking steps to finance constructionat Copperstone and get the mine into production by early 2024.

- The two small cash-flowing royalties and cash balance can cover G&A expenses indefinitely.

- The carbon credit portfolio isn’t worth the implied value of the Agnico Eagle investment or subsequent capital commitments, but it’s not worthless.

- We’ll mark the exploration royalties at zero.

- The warrant overhang from the IPO is a non-issue as they’ll likely expire worthless.

Here are my adjusted marks:

- Copperstone stream: CAD$16-million (original cost US$18-million)

- Carbon Royalty business: CAD$28-million

- Cash-flowing royalties valued at zero to balance out capitalized G&A expenses.

I haven’t stress-tested those valuations, but they’re close enough to make my point. With 73.2 million shares outstanding, there’s about 60 cents of value inside Star Royalties trading at 36 cents. When the blood really starts flowing and STRR.V trades below 30, I will be looking to step in assuming my valuations hold up after closer review.

Nothing much to say on the other listed names at the moment.