The following is custom research conducted on behalf of Consolidated Rock Holding Company. You should probably do your own due diligence and this should not be considered investment advice.

IBEX Technologies (TSXV:IBT) is a microcap company operating in the biomedical field. With a $2.5 MM market capitalization at its current share price of $0.11, the market is clearly not expecting big things from the company. However, the company has a very different business profile from the standard early stage pharmaceutical company. The more standard model is a team of researchers with an idea raise a pile of cash and then spend it trying to create a drug or medical device. That is very much a boom-bust model, where things are either a large success or an abject failure. IBEX has a less bifurcated future ahead of it, as its business is the manufacture of enzymes for various purposes. That means the company has revenue, and has been profitable year to date.

Products

The company has two primary products, the first (and most important) is a heparin blocking enzyme called Heparinase I. It attaches to Heparin, which is commonly used as a blood clotting drug, and deactivates it. That makes it useful as part of a test for how well a patient’s blood is clotting on its own. A blood sample can have Heparinase added to it, which deactivates the Heparin the patient has received, and a blood clotting test can be performed on the sample, which allows a determination of whether the patient still requires clotting medications, which have significant side effects.

From an investment point of view, having the enzyme used as a consumable in a regular test implies continued demand, especially given that Heparin is often used in the care of the elderly, which is a fast growing portion of the healthcare market.

The second product is an arthritis assay kit, used for evaluating cartilidge degradation. It is only approved for research use, which limits the end market to academic institutions and pharmaceutical companies for their internal use. If the company were to get it approved for use as a medical test for patients the size of their market would dramatically increase, although it seems additional research and significant regulatory expenses would be required for that to occur, so I have not included it as part of my valuation.

Corporate Governance

The company seems to have unusually good corporate governance for a firm of its size. The disclosures list no related party transactions at all, which is highly unusual in microcaps. Almost always is there a third party CFO getting paid for consulting work, or office space getting leased from an officer. While these transactions are often fair to the companies that do them (and often required as microcaps often don’t have the balance sheet to own their own buildings) the fact that IBEX is operating without them is a fundamentally good thing. There are outstanding stock options for between 4% and 5% of the outstanding shares, which is within a range I would consider reasonable.

The CEO also holds the office of Chairman, which is generally undesirable, but owns nearly 10% of the outstanding shares, which is very desirable. One of the other directors own a little of 3% of the shares, which means that inside ownership is strong enough for incentives to be ok, but the company is not controlled either, so would be subject to activist forces if they decided to abuse shareholders for some reason. Interestingly, the CEOs salary has been decreasing, and was $205,000 in 2015.

Customer Concentration

The company has one large customer that has accounted for 40% of its sales so far this year. That implies a significant dependence on that customer. They have a second large customer as well, such that their top two customers are approximately 50% of their business

The company has indicated that their biggest customer was on an inventory build-up during the first two quarters of fiscal 2016, and that the reduction of spending by this customer is responsible for the switch from a large profit to a loss in Q3. The veracity of this statement seems to be the most important risk factor facing the company, as if they are able to keep up their Q1-Q3 earnings pace the valuation is likely excessively cheap. However, the company’s most recent MD&A says the following:

As mentioned above, we have benefited in Fiscal Year 2016 from one customer’s need to build inventory for internal logistical reasons. As a result we expect that Fiscal Year 2017 results will be significantly lower than Fiscal Year 2016 as that customer returns to their normal purchase pattern.

Fiscal Year 2018 is expected to be an improvement on Fiscal Year 2017 as we anticipate a major customer will roll-out a new product. However, as marketing success is customer dependent, no assurances can be given that the revenues forecasted will materialize as planned.

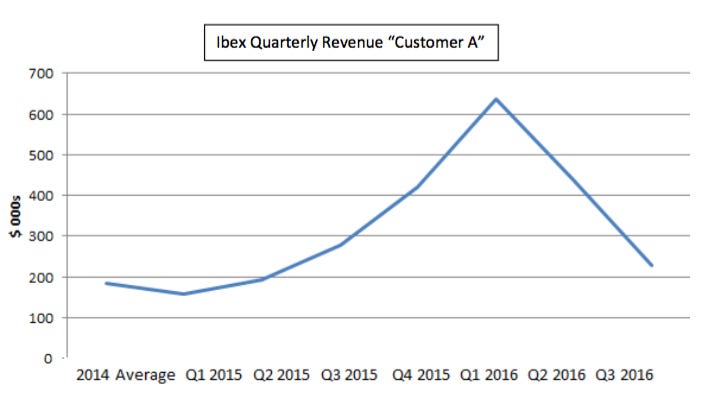

To forecast earnings going forward, I have generated what I believe is the quarterly spending by this customer for the current and previous fiscal year.

Given the trajectory of Customer A spending reported, it appears to me that the company received approximately $770,000 of extra revenue for inventory building between Q4 2015 and Q2 2016. Carefully reading the statement above and observing the return roughly to trend in Q3 2016, I am forecasting sales to Customer A of $225,000 per quarter going forward. That seems roughly consistent with the 2014–2016 sales trend excluding the inventory build-up.

The company earned $1.03 MM in the trailing twelve month period, so even if one assumes all of the ‘excess’ customer A revenue was 100% gross margin (and their costs are not likely to be all fixed) the company would still have earned $0.3 MM in the TTM period.

The risk to this approach is that their sales to other customers were also down 24% year over year and 33% sequentially in Q3 2016. If that sales performance to their remaining customers is the start of a trend rather than an aberration, that combined with lower customer A sales will be very value destructive.

Valuation

Assuming the company is able to keep its sales to its other customers at its TTM levels, the valuation at its current $0.10 share price is relatively attractive. Given that the business is of reasonable quality and that there are barriers to entry when one is growing proprietary blood coagulant bonding enzymes, 10X earnings is not unreasonable, even for a very small company, which would value the operating business at $3.0 MM.

The company also has an excellent balance sheet, with $4.0 MM of current assets against $1.6 MM of total liabilities. Given that nearly $3 MM of the current assets are cash, I think it’s fair to add the excess current assets to the valuation, which adds another $2.4 MM to the value.

The company also has land beside their US production facility that they have marked as held for sale with a valuation of over $0.4 MM, I’ll haircut that to $0.3 MM, simply to account for costs incurred in selling it and to add some conservatism. It’s worth noting that the company also has $2.2 MM of long term assets, of which $1.2 MM is land/buildings (not including the held-for-land). While these facilities are being used to generate the income that I capitalized above, it does add a bit of margin of safety to the thesis, as they could generate value from them either with a sale-leaseback transaction, or a straight sale if the company were to be liquidated.

Adding up the three sources of value above comes to $5.7 MM in proposed market capitalization. Given the company has 24.7 MM shares outstanding, that suggests a value per share of $0.23, more than double the current market price.

Other notes

The company has significant non-capital losses and investment credits, which should preclude them from paying tax for quite some time. Also, the company has been consistently booking depreciation at least 7X greater than the capital it spends on PP&E. The equipment it uses is evidently long-life, as are its owned buildings. This reduces earnings without a commensurate decrease in effective owner cash flow.

The biggest risk here is the business performance. If they can continue to make sales to their other customers at the rates they have been doing so, the valuation should re-rate, especially if they do something accretive with the cash. They did have an influx of cash from a lawsuit in 2015, and combining that with the excellent results in 2016 suggests that management should be more than comfortable with the cash balances. Given that cash on hand exceeds the market capitalization, there would be potential for an activist to come into play here, although it would be more likely to be an individual than a fund given the extremely small size of the company.

One interesting thing I noticed when looking at the liquidity (which is only a few thousand dollars a day on average) was that large blocks became occasionally available, but were taken up at material discounts to the previously prevailing price. This happened on June 21st, August 9th, and August 29th of this year. In each case hundreds of thousands of shares crossed, and the closing price decreased by between 5% and 27%. I suspect a market maker is buying blocks at a discount and then doling them out, so a carefully watched limit order combined with patience would be a good way to build a sizeable position at a discount here.